options and the power of options

According to this site, Options are essentially contracts between two parties that give holders the right to buy or sell an underlying asset at a certain price within a specific amount of time.

There’s quite a bit to learn about options. I’ve been trading options for nearly 5 years and I can tell you I’ve only scratched the surface. Here, I am doing two things to help you.

First of all, I will be listing a few sites that got me started. They’ll give you an overview of what options are, help you understanding the terminology - from the simple ones to the Greeks. Scroll down to the bottom of the page to see the resources I recommend.

Secondly, I’ll try to explain the basics in layman’s terms and show you examples of how Options can make $$$ quickly.

So, what are options?

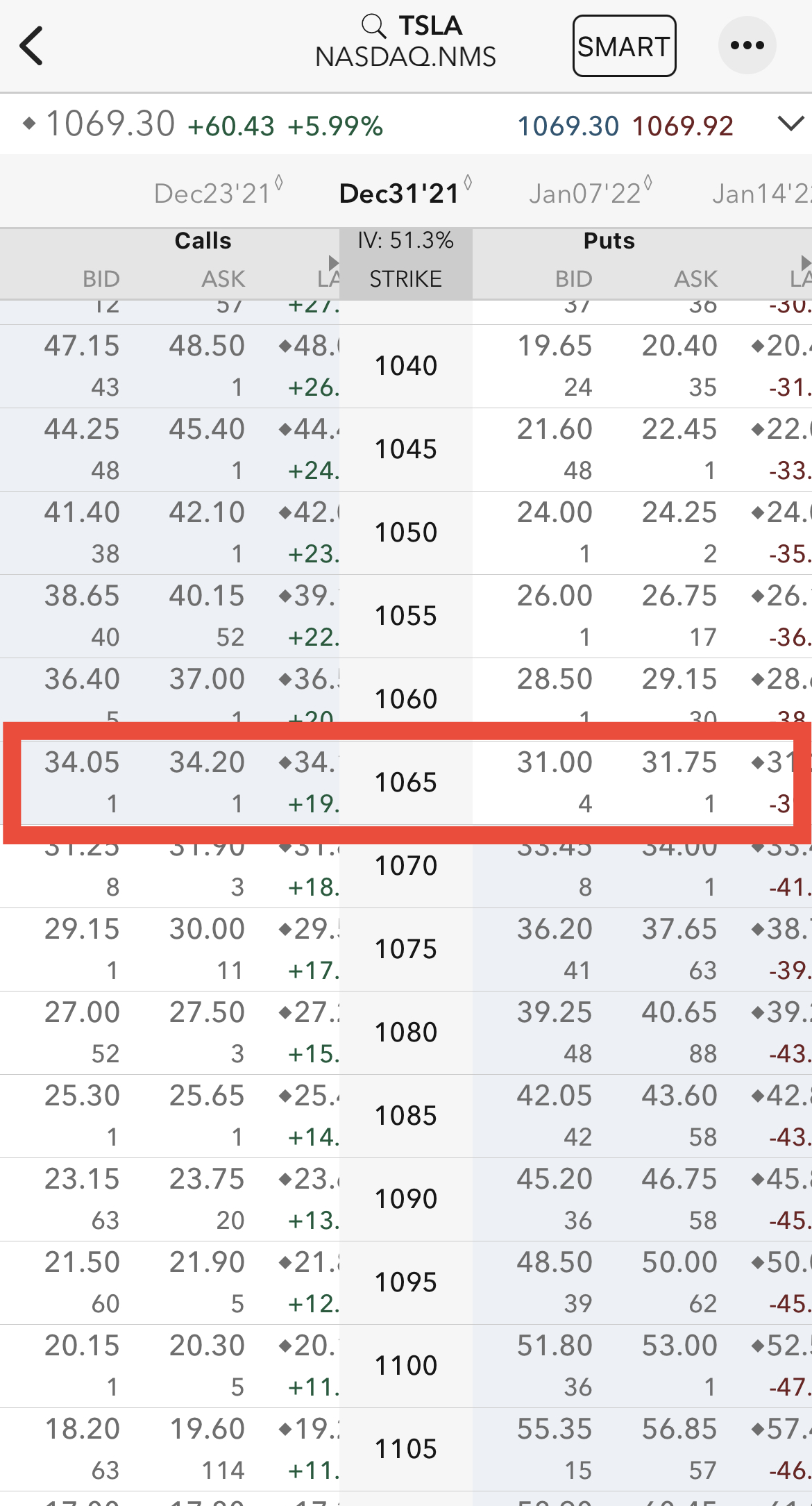

remember, 1 option is a 100 shares. If you look at your trading platform, you’ll obviously see a price associated with that option, just like there’s a price associated with any stocks. Now, remember, 1 option is 100 shares of the underlying stocks. So, when you see something like this in your brokerage, remember, always multiple it the price by 100 if you are going to buy 1 option.

Referencing the row highlighted, the CALL option of the Tesla 1065 Strike expiring on Dec 31 is 34.20 (ask). If you think the Tesla stock price is going up, you want to buy that 1 option, you’ll have to pay, $34.20x100=3420.

Similarly, the PUT option of the Tesla 1065 Strike expiring on Dec 31 is 31.75 (ask). You will want to buy a PUT option if you think the Tesla price is going down.

What’s a CALL and PUT?

This is a good article explaining it. But I promised you I’d explain this in layman’s term. So here we go:

CALL -> you think the stock price is going up

PUT -> you think the stock price is going down.

A lot of beginers ask why deal with options? Why not simply buy the stock prices? LEVERAGE! That’s why experienced investors trade options.

Options can provide leverage. This means an option buyer can pay a relatively small premium for market exposure in relation to the contract value (usually 100 shares of the underlying stock). An investor can see large percentage gains from comparatively small, favorable percentage moves in the underlying product.

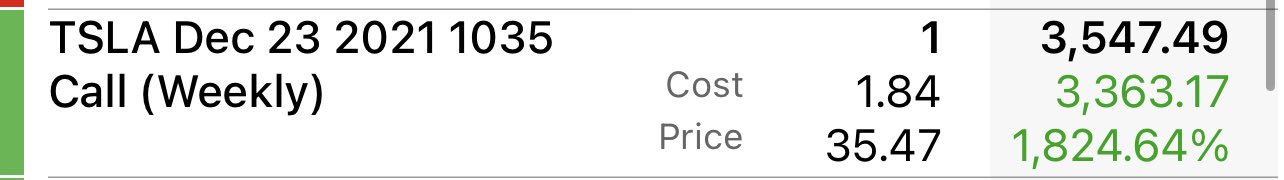

Take a look at the following sceenshots. I actually took this from Twitter.

What happened here?

This genius bought a Dec 23, 1035 strike Tesla option for 1.84. Remember, 1 option is 100 shares. So he had to pay $184 to enter the trade.

The option appreciated to $35.47, meaning he gained $3363.17 from a $184 dollar investment - a whopping 1824.64% gain.

How long do you have to wait, to achieve 1824.64% gain, if you simply bought the stocks?

Take a look at the following. Remember, option=leverage. Tesla went up by 5.93% to a price of $1068.70. But the option price went up 1824.64%.

Now read this twice:

Not all options will end like that. This trade is essentially a gamble. This option is expiring today on Dec 23. If the Tesla stock price was under $1035, this genius would’ve lost the entire $184. But think about it, this individual risked $184 to make $3363.17. That’s an amazing trade. As the old saying goes, gotta be good to be lucky, and gotta be lucky to be good.

What to look out for when buying options

stay tuned.